RockySpears

-

Posts

506 -

Joined

-

Last visited

Content Type

Profiles

Forums

Calendar

PW Shop

Posts posted by RockySpears

-

-

16 hours ago, Bazooka Joe said:

https://www.microsoft.com/en-us/software-download/windows7

Download it from MS, & just use your fathers Win 7 Key.

What if the key is OEM? OEM keys are tied to the components making up a pc/laptop, so it may not let you do this as the new laptop does not have exactly the same components. Look at the label with the Key on it, it should say if it is OEM or not,

Just thinking,

RS

-

If you have any device used for watching/recording live TV, then you still need the licence.

Even using something like a friends SkyGo, on your wifi at your unlicensed home is a no no.

RS

-

-

39 minutes ago, Pigeon Shredder. said:

trees are to be planted on Doddington Moor

Have to say, destroying one habitat to provide a different habitat because it might get pretty, fluffy things that people will pay to come and see is a bit off to me. But the environmentalists will think it a great idea though.

Sorry, not a good idea, IMHO.

Nice walks too apparently: http://www.christophersomerville.co.uk/?p=250

http://www.doddingtonnorthforest.com/

RS

-

How about the various enclosures by people like Maplin (or ebay or amazon etc etc) ? There is bound to be one the right-ish size.

https://www.maplin.co.uk/search/?text=enclosure

Yours,

RS

-

If you do not have the cables newly laid to your premises by the likes of Comcast/NTL/Virgin/any other "cable" provider, then you are using BT infrastructre.

As a one time Frames Engineer (Frames are where the actual, physical connections to your home are made) I can assure you that whether you have Sky, Talk-Talk, Orange etc etc, the cable, junction box etc are the same all the way back to your exchange. It is an OpenReach engineer that connects for Sky, Orange etc, they do not have their own engineers (or at least, did not when I left them a couple of years ago). So those getting "better" than BT are, in fact, using the same physical cables as BT, they own the cable from your house to the exchange, that is who the line rental fee goes to.

In the exchange, there is equipment belonging to the different BB suppliers and this equipment is connected to the BT Frame by OpenReach engineers.

Other than a few individuals, no one has fibre connected to their home. It is fibre to the cabinet, then crappy copper cable to your house via the telegraph pole for the older houses, or via the underground cabling system for newer homes. If you have a telegraph pole, then your cable could be 60-70 years old, and may NOT even be copper as, during the Uganda crisis, aluminium alloys were used.

For those in the countryside, you may not even know where your exchange is (it can look like a lock-up garage to be honest, and they generally have no external indication that they are BT property. This is an attempt to stop scrotes stealing the cables.

You can find your exchange here : Timperley, for example WA15 7UN, is 2Km from the Altrincham exchange.

Hope this is of interest to some at least,

Yours,

RS

-

Just now, bigman said:

I might try to get a trail cam because not knowing is bad for my head

Yes, but if it is an armed bear, you may be worried!

RS

-

Each coin mined, makes the next one harder to mine (more maths to do, so more computing power needed).

Currently it is estimated that 0.13% of the worlds power is used to mine Bitcoin.

This is a 29% increase on the power needed a month ago,

By February 2020, BItCoin miners will consume ALL the worlds power.

https://powercompare.co.uk/bitcoin/

Go figure,

RS

-

Is the reason that only the head goes is because the fox gets overexcited at the food abundance, it kills all it can, but can only eat so much?

Sure I read that somewhere, "or did I dream it?",

RS

-

OK, its that simple. Whether or not money changes hands, seller/giver signs buyers/taker's FAC assuming the Calibre and quantity are OK,

Thanks,

RS

-

Hi,

Probably a simple one, but finding a definitive answer seems difficult:

Who can sell you ammunition (not re-loads), eg .22lr, .38/.357 etc etc ?

Does all bought ammunition go on your FAC?

I can see that people here often seem to sell off unused ammo, but how is this handled with regards FAC (if at all).

Shotgun carts I can find plenty of info, just not rim or centre fire?

Thanks,

RS

-

For future reference Figgy, try Hawk Fasteners on Skippers lane, I work just a short walk from there:

http://www.hawkfasteners.co.uk/

RS

-

" David Icke's" No, not ever, he seems a little unstable to me.

" dodgy source," The European Central Bank? Bill Blain? ZeroHedge - Dodgy because Wikipedia says so? What is a good source?

"tables of figures" these were provided by a contributor to the discussion, I merely expanded the data set (from the same site) to show that between them, the Banks and The Government are NOT there to help us and indeed actively destroy an individuals wealth.

grrclark Yes, lots of ways to interpret/calculate inflation and lots of causes. However, how does this in anyway affect the FACT that the Bank of England is mandated to have a 2% inflation rate? Why does it not aim for 0% and try and protect our money from the devastating effects inflation inflicts? I think I have shown that our Wealth is being eroded by these institutions and no one seems to think twice about it and given that that was my aim I think I have done so. I think I have tried show the PW readers that they must look to their own way of managing their wealth.

Gordon R You brought up Gold, what about it? I never mentioned it? Some sort of "barbarous relic" is it not?

"what is he suggesting - sticking the money under the bed" It would have been a better investment if you had done so, I think I showed that. Some would just use the savings rates and shown that the £100 had in fact grown to £1,527.50 and Joe public goes "Wow, great job Banks", what Joe was never shown was that his £1,527.50 now, had the purchasing power of £75.2 or, after tax deduction on interest, about £60. It is this disingenuous nature of the financial world. They utterly fail to inform Joe that they have taken him for a ride and that bugs me.

Thanks to all for the discussion,

Yours,

RS

3 hours ago, JohnfromUK said:Put £100 under the mattress - and when you take it out it is still £100, but due to inflation, it buys you less goods (because the price of goods has inflated).

Put £100 under in an interest bearing account - and when you take it out it will be more than £100 (due to interest (less tax)), it may buy you more goods, or due to inflation, it may buy you less goods. It depends on whether inflation has been higher than the net interest received. Some years it is, some it isn't.

I love it when posts cross. Missed that due to 2nd Page of posts

I love it when posts cross. Missed that due to 2nd Page of posts

Thanks John

RS

-

6 hours ago, Gordon R said:

In your case, I am here to criticise. You really need to go back through your responses to others and get hold of a dictionary.

Your assertion, that we are here to learn, is mildly musing, as you seem intent on dismissing others' opinions.

No opinions dismissed, just replied to, often with referenced material.

5 hours ago, old'un said:RockySpears

Little bit deep for me but are you saying everyone with money in the banking system will be unable to access their money if the banking system goes breasts up?

Pretty much, yes, it may. You may look up what happened in Cyprus, one morning, people woke up and the Banks were shut and the ATMs limiting cash withdrawls: https://news.sky.com/story/cyprus-bank-limits-cash-withdrawals-amid-crisis-10451007

SxS - yes, I read it and it does say " while taking into account potential liquidity " so they get to decide the amounts, noot you.

"I't's really not quite so scary " Sounds scary to me, they will let me know if I can have MY money, that's nice of them.

Who said Inflation was a Conspiracy? It is a fact, 2% is a BoE target, their aim is to destroy your spending power.

Gordon R - you can look that up. I am sure some here got it.

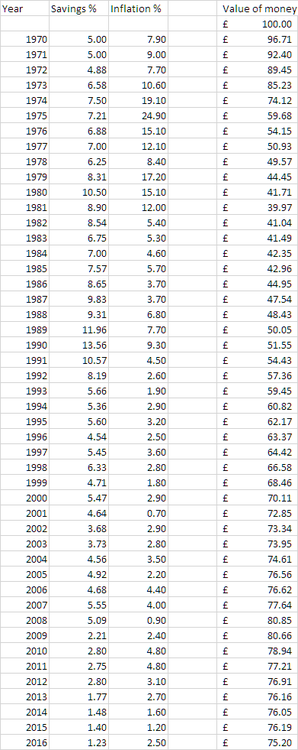

JohnfromUK - No, I believe you, but you stop at 2000. Total Inflation since 1970 = 1,412.73%. But if we look at inflation and savings (from your site) What happens to £100 invested in 1970?

So you now have £75.20 left of your £100 investment, Yeah, gotta love the banks. If you put Your £100 under the mattress, you would have 25% more than if you put it in a Bank. Really working for us those Banks aren't they?

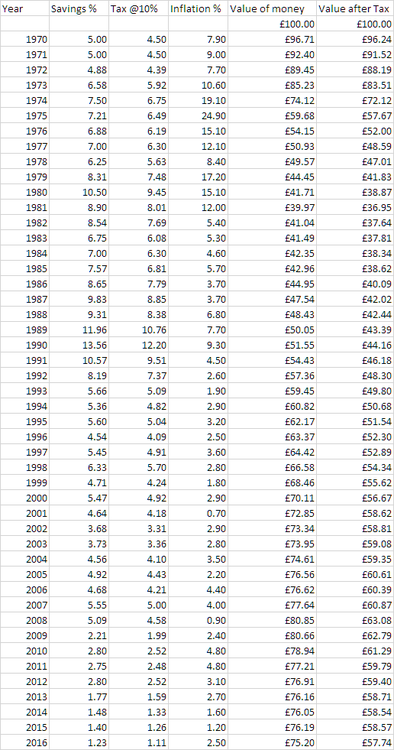

Oh, and if you pay Tax on your interest (let's face most of us do), guess what?

I'll be kind and only use 10% tax rate, despite that between 1970 and 1991 the rate was NEVER lower than 25% ( I do not know how long Interest has been taxed, but is a long time and using 10% seems fair to me) I have simply reduced the Savings % by 10%.

Your £100 turned into £57.74 !!

Looks like between them, the Banks and Gov. got our backs lads and lasses, Yes?

Night night,

RS

-

3 minutes ago, Gordon R said:

I dangled the bait and you couldn't resist. Your "style" is patronising. There is no need to produce lengthy posts, which merely emphasise my point.

I fully expect a "devastating" put down - no more to be said. You can't help yourself.

Do you consider someone to be "patronising" when explaining things? Puting forward their opinions and defending their points of view?

Are we not here, on this planet to learn?

"Everyday is a school day."

Care to add anything meaningful to the discussion, or are you just here to criticise?

RS

-

Option 2. may not be bad, would it be of use to anyone else?

Does it attach to property of yours? Does it attach to the old business? Is it even Freehold?

Is it accessible from public highway? Land not accessible except by another property is not usually considered of any value, except to the surrounding properties.

Have you checked with land registry to actually ascertain ownership? Last time I did this, earlier this year it was £3.00

Yours,

RS

-

15 minutes ago, Gordon R said:

You are all obviously "Establishment orientated", although I am slightly bemused by this quantum leap in judgement. It is almost Olympic level.

Nonetheless, I like RockySpears' patronising posts. Leave him alone.

" patronising posts"

I insult no ones intelligence, merely answer points laid out by others.

I insult no ones intelligence, merely answer points laid out by others.

Further work has re-enforced the ZeroHedge article: ' The latest wizard wheeze from the ECB is a real sweetie… according to a discussion paper published by the ECB last week on revision the Union’s crisis management framework; if a bank looks wobbly, then: “covered deposits and claims under investor compensation” should be replaced by “discretionary exemptions”.'

and if you think Bill Blain is some Conspiracy/Fringe type of guy then, good luck.

I merely point out that people here may think the money they have in the Banks is "safe", well, its not. I think that warning other PW members that all is not rosy in the world of finance is not a bad thing.

4 hours ago, JohnfromUK said:Well, there were a number of sites saying that the world was going to be annihilated by a planet (which no one has ever seen) called Niburu on Sunday last weekend. The "Establishment' assured us it was incorrect. Most people believed the Establishment - and here we are on Monday all still here, no sign of Niburu! That doesn't really make us "Establishment orientated"!

In the event that this does come about, I'm sure there will be notice - and it is also likely that the UK will not be in the EU by the end of that notice period. UK banks (as has been pointed out) are protected by UK Financial Services Compensation Scheme, currently up to a value of £85,000 - the £85,000 figure is I believe set to align with the EU - presumably 100,000 Euros?

"Well, there were a number of sites saying that the world was going to be annihilated by a planet (which no one has ever seen) called Niburu on Sunday last weekend. The "Establishment' assured us it was incorrect. Most people believed the Establishment - and here we are on Monday all still here, no sign of Niburu! That doesn't really make us "Establishment orientated"!"

Ah, an attempt at arguing that my point is not a good one because some other, totally unrelated point, was not a good one either. Sad attempt, easily spotted. I would be surprised if the "Establishment" ever said anything about Niburu, because, like Flat-earthers, its nonsense, in my opinion.

It is what the Establishment DO NOT say that does the most damage, when they seem not to even acknowledge that there is a problem.

Let me try this: Inflation, good or bad?

The Bank of England has a mandate to turn £100 of your buying power, into £98 a year later. It has a target of 2% inflation. Think about that, it is a mandate to make your money worth less each year by increasing the price of the goods you need to buy!

The Government (of any colour) wants your money worth less, year on year. Do you want your money worth less each year?

Inflation is mentioned everyday pretty much, in the MSM, almost as if it were a good thing. It is not, inflation is bad. Growth, now that is good (the two should not be confused) that means we have more each year.

The BoE works to destroy your wealth, that is something you might think on. There is a reason for it and it is inextricable linked to our money being Debt, but that's another post.

Yours,

RS

22 minutes ago, Mungler said:Outside of websites flogging gold, it was re-reported on Russia Today so it must be true...

It is on the European Banks website for goodness sake, as well as other financial sites

RS

44 minutes ago, Gordon R said:You are all obviously "Establishment orientated", although I am slightly bemused by this quantum leap in judgement. It is almost Olympic level.

Nonetheless, I like RockySpears' patronising posts. Leave him alone.

"You are all obviously"

Nope, never said that ALL were anything at all,

Keep trying,

RS

-

2 hours ago, SxS said:

The article you linked to was submitted to a blog site of questionable reliability (https://en.wikipedia.org/wiki/Zero_Hedge) by a company focused on selling you physical gold (who would clearly have an interest in encouraging people towards alternative wealth storage options). It also contains a lot of very selective quotation...

I find it odd that, were such a proposal really in the works, it has not have received wider media coverage in the past couple of weeks?

Maybe the document doesn't say that deposit protection schemes are unnecessary and might go?

1. "Maybe the document doesn't say that deposit protection schemes are unnecessary and might go?" Read it.

2. ZeroHedge, you claim, is questionable, using Wikipedia to prove it

3. "it has not have received wider media coverage" of course not, why would the MSM want to tell people something that they might object to?

4. "It also contains a lot of very selective quotation... " yes, it' called 'quoting'. If the quotes are there, what matter that you only pick those ones out?

5. "I find it odd that, were such a proposal really in the works" Then maybe you need to read more than the BBC and FaceBook. Try the European Central bank website for yourself then. https://www.ecb.europa.eu/ecb/legal/opinions/html/index.en.html It is currently Number 1. "Opinion on revisions to the Union crisis management framework (CON/2017/47), 10.11.2017."

I really had no idea that some Pigeon Watch members might be so Establishment orientated.

Yours,

RS

-

57 minutes ago, SpringDon said:

Seems like a testing the water document rather than a serious proposal. Our guarantee is from the fsc rather than ecb. It seems unwise to even mention such a thing while the euro zone crisis is still unresolved.

" It seems unwise to even mention such a thing "

One would think so, but they feel themselves to be completely above everything going on. How must Italians feel? Their Banking system is almost in meltdown. Colleagues there tell us they keep very little in the Bank as they feel one day, they will wake up and not be able to use ATMs or get money out over the counter (think Cyprus).

Many seem to have the attitude "It can't happen to me", but they are so wrong. If you do not look after you own money, do not expect the Banks to bother.

Yours,

RS

-

In the UK (and across the EU), there is currently a protection on up to £85,000 of your deposits in a Bank, if it goes under, you are supposed to get all your money back.

Well the European Central Banks think it is not right that they should honour the money you have in them (savings, current accounts etc etc)

"It is the 'opinion of the European Central Bank' that the deposit protection scheme is no longer necessary:" (see attached, it is all legalise and Bank speak, but you can get an idea of its content here)

They may let you access an amount they deem necessary for daily living expenses, but other than that "all your monies are belong to us"

When you put your money in a bank, you may think it is yours, but it is not, you "Loaned" it to the Bank and you are now a Creditor, and a very lowly one at that. If a Bank goes under, you will be just one of a long line of Creditors, many of whom will have a prior claim to yours.

It is my opinion (and practice) to keep only what is needed day-to-day in a Bank. They are not giving you anything in return for your handing them your money, but they will keep it by whatever "legal" means (terms and conditions) they can.

Most here probably have very little in savings, maybe a few £1,000. The question I ask you is; "Can you afford to lose it?"

Yours,

RS

-

I change banks (or at least they think I do) whenever an decent offer is made, TSB just gave my family £1250 (5x£250) when we all "appeared to switch to them.

I open Bank accounts all over, this means I have something to "switch"" from. Each has a Direct Debit or 2, Gas, electric, Council tax, Water, Insurance (yearly), phones etc etc, they only ever seem to want 2. Transferring in £1,000 or so a month and moving it on to the next means you comply with their In/Out requirements.

They do not care for us, so we should not care for them.

Oh, and it is they who are responsible for most of our current ills (and have been for many decades).

Yours,

RS

-

22 hours ago, Wb123 said:

When they can borrow from the Bank of England at next to nothing and are so limited in who they can lend to by historical standards my understanding is that the banks simply don't need our money. In older times they needed our money to lend out but now current accounts and savings accounts only yield any profit via charges or people sticking with the same provider for credit.

I suspect it it is only a matter of time before charging for current accounts is the norm unless there is a significant shift in how the system works. Halifax have looked after my current account and credit card very well for years and it won't have made them a penny, not viable for the long term.

-

2 hours ago, old'un said:

Time to buy some shares in producers of home brew kits

Look up "Wurzels Orange Wine". I make a load of variations of this in 5L water bottles from Tesco (or wherever you buy water from) to be honest I pour away the water and use the container. 5L wine takes a couple of weeks and cost about 40p per L at 12% alcohol.

RS

-

"What is your favoured model in place of the banking system?"

A Banking system where a private company (Barclays, HSBC etc etc) CANNOT create money from thin air. Why should a private company be able to create money? Why not me?

Banks used to lend what they had assets to cover (Land, goods or actual money), if they got it wrong, they went out of business. Those that say this prevents growth do not seem to realise that this was the way until very recent history, 100-150 years ago. Once the Banks were given the ability to create money from nothing and take Interest on it, it all started to slide.

Take a look around you: Take a look at an old Town Hall, Railway Station, Government building; look at the architecture, the stonework. No one can afford to do that these days, no one can build a St Paul's or a Houses of Parliament building. Why? Because our money is so debased, our economy so poor, inflation has destroyed our "Wealth".

We claim to be a 1st World Country, but I believe we are actually all in the 3rd World and we just do not know it yet, the 1st World has gone.

Yours,

RS

4 minutes ago, Red-dot said:Oi! Start your own topic.... FOOD banks not MONEY banks.

The sooner people understand the connection, the better.

As you wish,

RS

Estimated for gun repair

in Guns & Equipment

Posted

Now just to confuse things, I have recently acquired a "Lancer" O/U and it does exactly this. Each barrel fires, but the safety interjects itself every time. Push safety forward again, second barrel fires. Keeping the safety forward does not work, you must pull it back and push forward again (dry-firing snap-caps).

I tried this evening to have a look myself, but, unlike my Winchester Pump, which I can strip down, I cannot seem to do more than break it into 3 bits, forend, barrels and stock. I did not spend a fortune, but I thought I would get some use out of it for social shooting.

Any ideas on getting inside? I can at least clean up inside if it is "swarf" or such. There are no screws or or pins visible to have a go at,

Thanks, and apologies if this is hijacking the thread,

RS